Providers are offering fewer and fewer policies because of costlier climate-fueled fires, homeowners moving into riskier areas, and outdated regulation of the insurance industry.

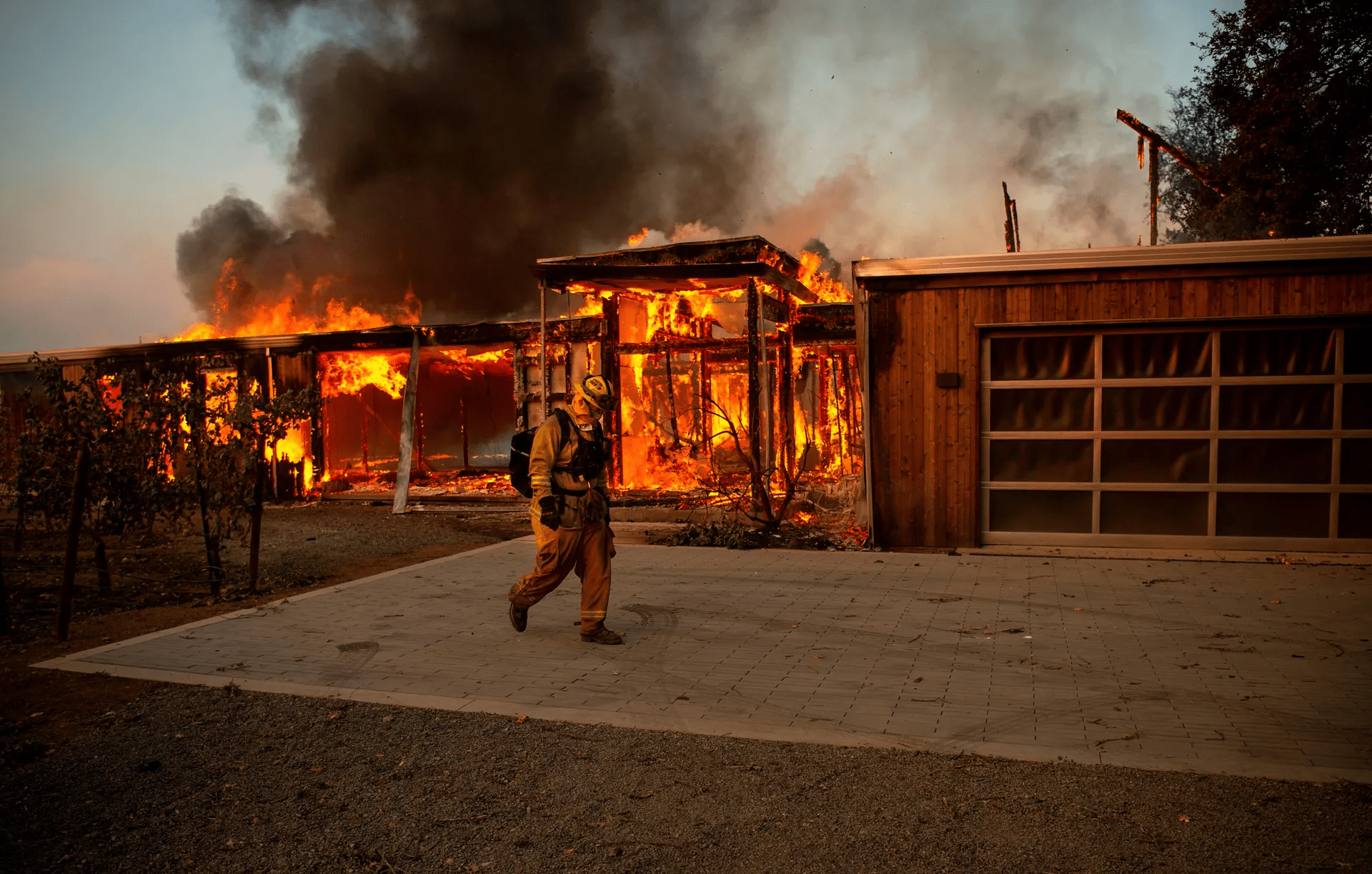

California is in the middle of a wildfire crisis. Nine of the 10 largest fires in the state’s history have occurred in the past seven years, as have 13 of the 20 most destructive. Just this past month, Southern California has seen three of the most severe fires in recent memory, while it recently took firefighters more than two months to contain the fourth-largest fire in the state’s history. All told, since 2017 wildfires have caused over $30 billion of damage across the state.

Alongside this crisis, Californians are dealing with a related crisis closer to home: many are finding it harder and harder to obtain homeowner’s insurance. In recent years, Allstate has stopped taking on new customers and increased rates for existing ones. Liberty Mutual has raised rates and has also not renewed the policies of 17,000 long-term customers since last fall. Rates are also up at California’s largest insurer, State Farm, and it, too, has chosen to stop writing new policies—as well as choosing not to renew 72,000 customers’ policies earlier this year.

The situation has gotten so dire that multiple counties have asked state officials to declare a state of emergency over the difficulty of obtaining home insurance. The First Street Foundation, a US nonprofit that studies the financial stakes of climate risks, has even labeled some parts of California as “essentially ‘uninsurable.’”

“Homeowners in high-risk areas are already in crisis, and the problem is spreading,” says David Russell, a professor in insurance and finance at California State University, Northridge.

Doug Gaylord and his wife own a home in Nevada County, about an hour outside of Sacramento. Their insurance policy was not renewed by State Farm this summer.

“We got a letter at the end of April saying we’d be dropped on July 6th,” Gaylord says. In that letter, which has been seen by WIRED, State Farm said that “policies that present the most substantial wildfire or fire following earthquake hazards, or are in areas of significant concentration, are no longer eligible.”

The Gaylords had been with State Farm for over 20 years and were left scrambling to find a new homeowner’s insurance plan. With few other options, they were forced to go on the California FAIR Plan—the state-backed insurance plan of last resort—for their fire insurance and use other providers for the rest of their coverage. They are now paying around $7,500 for everything their State Farm policy used to cover: about twice as much as they were paying last year. “Nobody’s offering coverage up here anymore,” Gaylord says.

Suzanne Romaine faced a similar problem with a home her family owns in Siskiyou County on California’s northern border. Their insurance policy was not renewed by State Farm earlier this year.

“My whole family has been with State Farm for maybe 75 years. They sent us a letter in July saying that they would keep us if they could, but had no choice and were canceling in August,” Romaine says. Simultaneously, there was a large fire burning that threatened the Scott Valley area, where her home is. It has since been extinguished. Her family is now also paying substantially more for insurance than they were last year.